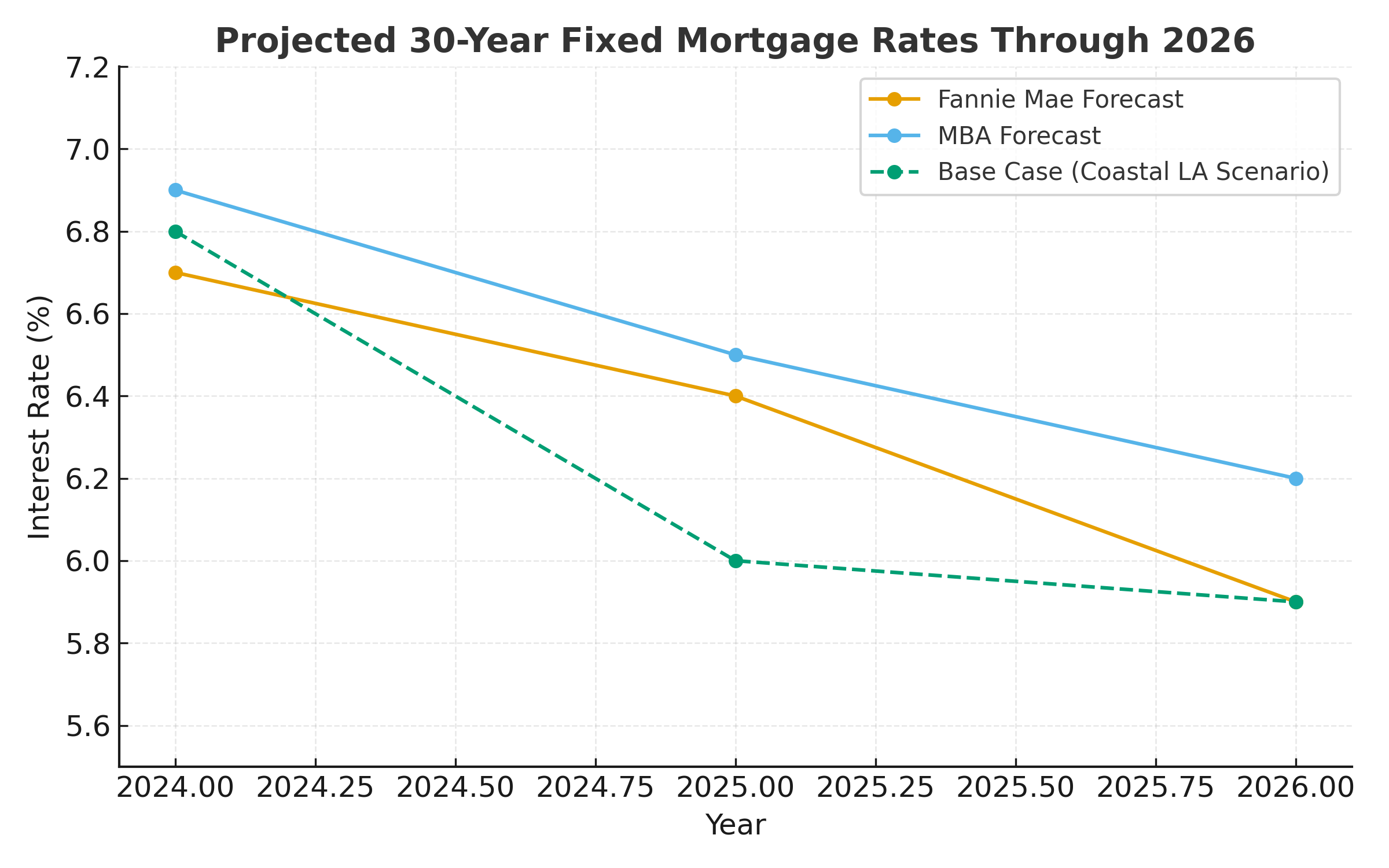

After a bumpy two years, the rate picture is finally getting clearer. The headline: economists generally expect modest, gradual easing into 2026, not a return to the 3% era but a drift toward the high 5s or low 6s as inflation cools and the Fed moves further into a cutting cycle. Fannie Mae’s research team pegs the 30-year fixed near 6.4% by the end of 2025 and roughly 5.9% by the end of 2026. The Mortgage Bankers Association is more cautious, suggesting rates could hover at or above 6% for several years, a function of stubbornly high long-term Treasury yields and fiscal pressures.

Why the divergence? It comes down to inflation and the 10-year Treasury. The Fed’s own September projections (the “dot plot”) point to additional policy easing in 2025 and 2026 as inflation grinds closer to target. If that happens and growth glides lower rather than collapses, funding costs should ease. Some on Wall Street see the funds rate landing near 3 to 3.25% by mid-2026, which would be consistent with mortgage rates gradually stepping down but not plunging. Meanwhile, current prints on inflation are trending in the high 2s to around 3%, supportive of the “slow and steady” path.

Where we are today: the 30-year average has slipped to the lowest level in over a year as Treasury yields cooled and markets priced in more Fed cuts. That has created a little breathing room after a long stretch above 6.5%.

What This Means for Coastal Los Angeles

For buyers: If rates ease toward the high 5s in 2026, monthly payments improve, but not enough to trigger a massive affordability miracle. Expect more step-function demand, where every quarter- to half-point drop unlocks a group of households who were previously on the sidelines. In Westside and coastal micro-markets where inventory is tight and lifestyle demand is durable—think walk streets, view corridors, or beach-adjacent homes—this new demand tends to firm prices quickly, particularly for turn-key properties and anything with outdoor space or ADU potential. Translation: if you have been waiting for 4% rates, that movie is not on the 2026 schedule, but if you want a better entry point than 2023 or 2024, you may get it. Lock shorter rate-lock windows when volatility is low, and have your lender ready to float down if pricing improves.

For sellers: California’s trade association is already modeling price growth resuming into 2026 as rates ease and affordability inches up. Statewide medians are not the whole story, but the direction matters. In our coastal pockets, an extra half-point drop often revives move-up buyers who were rate-locked in place, which can thicken the buyer pool for mid-to-upper-tier homes without sparking a frenzy. If you are planning a 2025 or 2026 sale, use the next few quarters to de-risk the listing through repairs, permits, solar documentation, and insurance clarity so you can meet that tentative demand on day one.

The Base Case and the Swing Risks

Base case: Inflation cools toward roughly 2.5% to 3%, the Fed trims rates methodically, and mortgages drift to around 6.0% by late 2025 and between 5.8% and 6.0% in 2026. That supports stable to modest price gains locally, with stronger competition for well-located, renovated homes.

Upside: A faster disinflation and soft-landing combination (Goldman’s scenario) pulls the funds rate lower by mid-2026, and mortgages flirt with the mid 5s, unlocking more move-up and second-home demand.

Downside: Sticky inflation or persistent 10-year yields keep mortgages north of 6% longer (MBA view), capping price appreciation and extending time on market except for A-plus inventory.

Bottom Line

For coastal L.A., 2026 looks constructively boring, and that is a good thing. Expect a market that rewards preparation and precision more than timing heroics. Buyers should focus on payment, location, and quality, and use temporary buydowns or ARMs thoughtfully if they bridge you to a refinance window. Sellers should lean into presentation and pricing discipline. If rates print a “5 handle,” be ready—your best buyers will be too.

Sources:

Fannie Mae Economic & Housing Outlook, September 2025

Mortgage Bankers Association Forecast, October 2025

Federal Reserve Summary of Economic Projections (“Dot Plot”), September 2025

Bureau of Labor Statistics CPI Summary, October 2025

Goldman Sachs Global Investment Research, “U.S. Rate Outlook 2026”

California Association of Realtors 2026 Housing Forecast